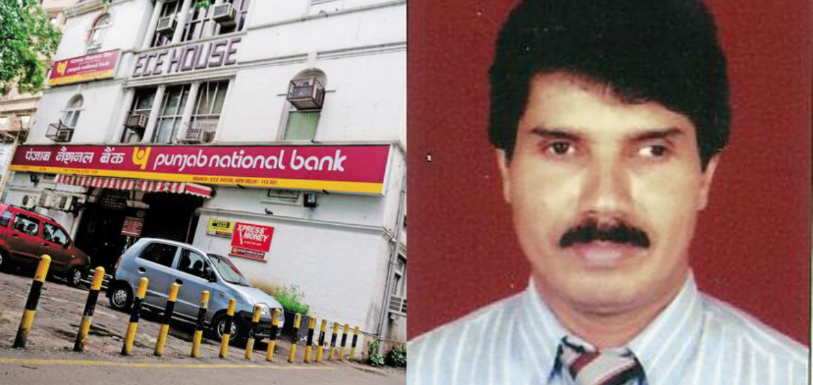

Today, the Central Bureau of Investigation (CBI) arrested Punjab National Banks’ (PNB) Ex Deputy General Manager (DGM) Gokulnath Shetty along with two others. They will be presented before the CBI Special Court in Mumbai later today. On Friday, the CBI reached Shetty’s residence in Malad but were not able to find him. CBI said, “He (Gokulnath Shetty) was untraceable since a few days.”

The CBI filed a fresh First Investigation Report (FIR) in a case against the maternal uncle of Nirav Modi, Mehul Choksi. The FIR states Mehul Choksi and his three companies swindled PNB of Rs. 4,886.72 crores in 2017 and 2018. Choksi is said to have got 143 Letters of Understandings (LoUs) issued through PNB.

The first FIR registered for this case states Rs. 280.7 crores were swindled through 8 LoUs in 2017. The total loss to PNB sums up to around Rs. 11,400 crores. The CBI said Modi and his relatives renewed most of the LoUs in 2017. On Friday, the CBI questioned 4 PNB officials in connection with the case for the dealings between 2014 and 2017.

The four officials under investigation were the Chief Manager of PNB’s Nariman Point branch in Mumbai Bechu B. Tiwari (between February 2015 and October 2017,) current DGM and Assistant General Manager (AGM) of Brady House branch (between May 2016 and May 2017,) Concurrent Auditor Mohinder K. Sharma (between November 2015 and July 2017,) and Single Window Operator Manoj Kharat (between November 2014 and December 2017.)

The FIR registered against Choksi says, “Accused Bank officials Gokulnath Shetty and Manoj Kharat in connivance with accused companies and directors during 2017 to 2018 defrauded PNB to the tune of Rs. 4886.72 crore in issuance of fraudulent and unauthorised LoUs in favour of foreign branches of different India based banks and purported LCs (Letters of Credit) in favor of foreign suppliers of the accused companies.”

The FIR further names 16 accused including Choksi, his three companies (Gitanjali Gems, Gili India and Nakshatra Brand,) one Managing Director, 10 directors and two PNB officials along with other unknown people. It is said apart from the 143 LoUs issued, Choksi also received 224 Foreign Letters of Credit (FLCs) through PNB.

The FIR stated, “Funds raised were meant to be used for payment of import bills of accused companies whereas it was dishonestly and fraudulently utilized for discharging the earlier liabilities on account of buyer’s credit facility by overseas branches of Indian banks.”

Shetty and Kharat refrained from making entries in PNB’s Core Banking System (CBS) of the LoUs issued for Choksi. This is said to have been done to avoid detection.

In a complaint to the CBI, PNB raised questions about the conduct of officials in the foreign branches of various banks. According to the Reserve Bank of India (RBI) guidelines, LoUs for trading jewelry and diamonds is issued only for a period of 90 days while PNB officials issued LoUs for a period of 6 months to 1 year. This should have raised an alarm in the foreign branches.